The Lender’s Equations How Much Mortgage will you Qualify for

Example of TDS ratio calculation. For instance, consider an individual with a gross monthly income of $11,000 and monthly debt obligations of $4,225. The TDS ratio, calculated by dividing $4,225 by $11,000, yields 38.4%. This figure is crucial in determining loan approval, with lower ratios generally improving the chances of securing a mortgage

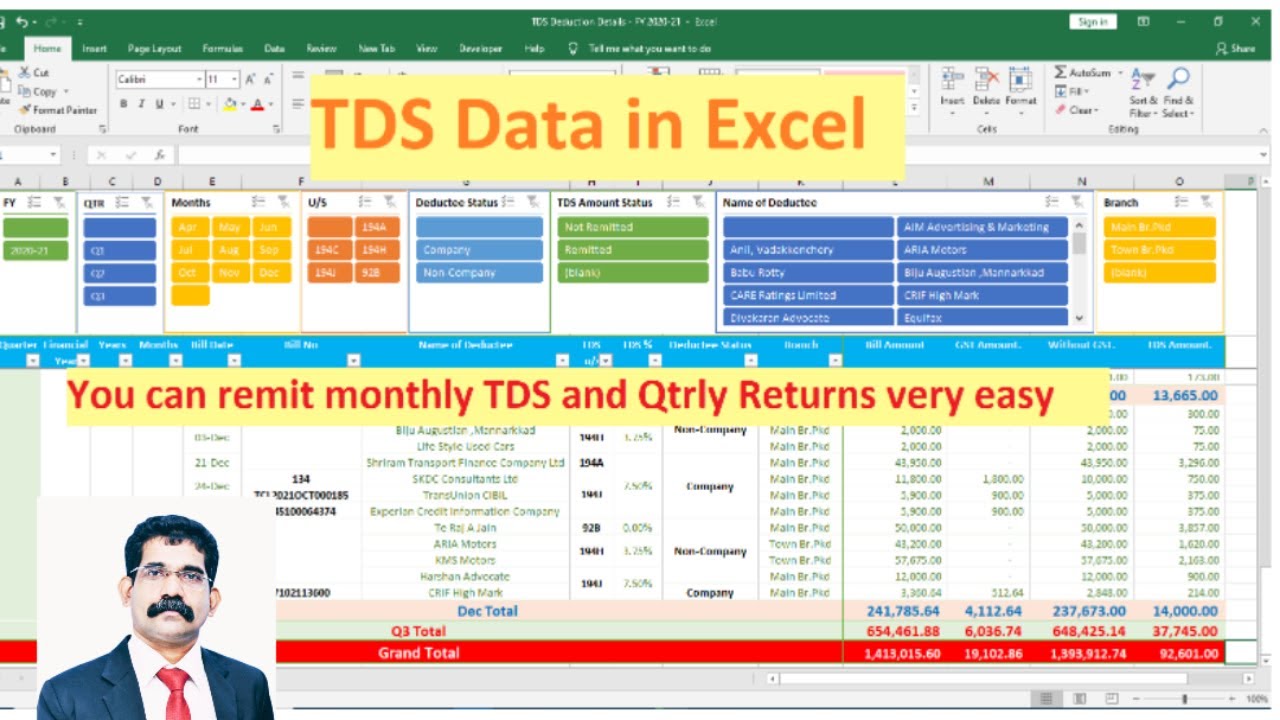

How to Calculate TDS in Excel TDS Calculator 24Q 26Q SVJ Academy

Total debt service ratio (TDS) Calculating your GDS ratio and TDS ratio is vital when applying for a mortgage in Canada. Every lender has guidelines to assess the risk they are willing to take on a client's mortgage when it is not insured by default insurance. Note: You must pay for default insurance on high-ratio mortgages.

FULLY AUTOMATIC TDS CALCULATION SHEET

What's a good GDS and TDS ratio? Ideally your GDS and TDS should be below 35% and 42% respectively. Given that Breezeful works with 30+ lender partners, we're able to support up to 45% and 47% for GDS and TDS ratios, and up to 50% for both under certain conditions e.g. a downpayment of 35%. Your GDS TDS. GDS: 0.00%TDS: 0.00%Calculate your GDS.

TDS in Water What it is & How to Calculate

How to calculate your debt-to-income ratio. To calculate your DTI, enter the payments you owe, such as rent or mortgage, student loan and auto loan payments, credit card minimums and other regular.

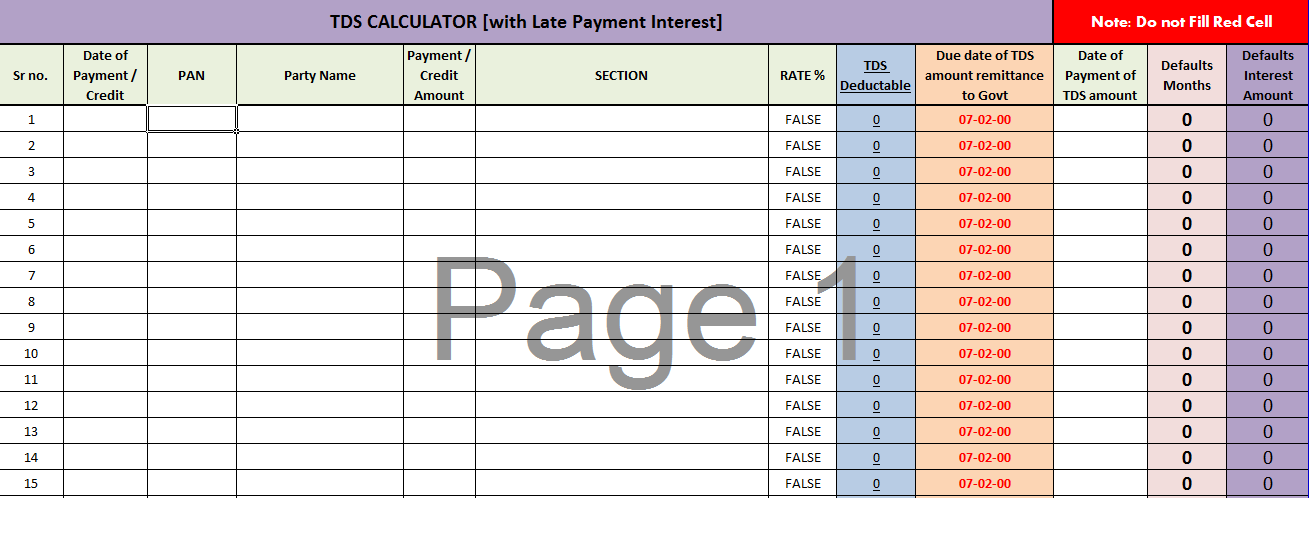

TDS Calculator Calculate TDS amount, rates & due dates Quicko

Based on your GDS and TDS ratios, you could qualify for a mortgage with a maximum amount of $201,369.98, or a home with a maximum cost of $251,712.48 - assuming that your down payment would be the same percentage as what you entered in the calculator (20.00%). Moreover, based on values you entered a summary report can be produced.

How to Calculate Total Debt Service (TDS) Ratio? YouTube

Mortgage professionals use 2 main ratios to decide if borrowers can afford to buy a home: Gross Debt Service (GDS) and Total Debt Service (TDS). This calculator will give you both. GDS is the percentage of your monthly household income that covers your housing costs. It must not exceed 39%.

Debt Service Ratios How to Calculate GDS and TDS

TDS Ratio Calculator Descriptions Amount; 1. Total amount of monthly fees from the above table $_____$ 2. Car loans 3% of your credit card limit and 3% of your line of credit limit

New TDS Calculator (Updated) in Excel

Debt Service Ratios: CMHC restricts debt service ratios to 39% (GDS) and 44% (TDS). Principal and Interest*: Payments should be based on the applicable amortization period and loan amount, including the CMHC premium. Taxes: Include the property tax amount. Condo Fees and Site or Ground Rent: If applicable, 50% of the condominium fees must be included in the GDS and TDS calculations.

How to calculate TDS in Purchase invoice Fresa Blogs

The debt ratio formula calculation is the same as that of the GDS, except all of your monthly debts are taken into consideration. This includes car payments, credit cards, alimony, and any loans. The industry standard for a TDS ratio is 42 per cent. To calculate your TDS ratio, add all of your monthly debts and divide that figure by your gross.

GDS/TDS Ratios Explained

Your TDS should not be higher than 40%. The costs considered in TDS include: credit card payment. credit line payment. car loan payment. Continuing with the example above, if you add a $100 credit line payment and a $300 car payment to the $1,350 housing costs, the bank would calculate $1,750 divided by $4,500. The TDS would be 39%.

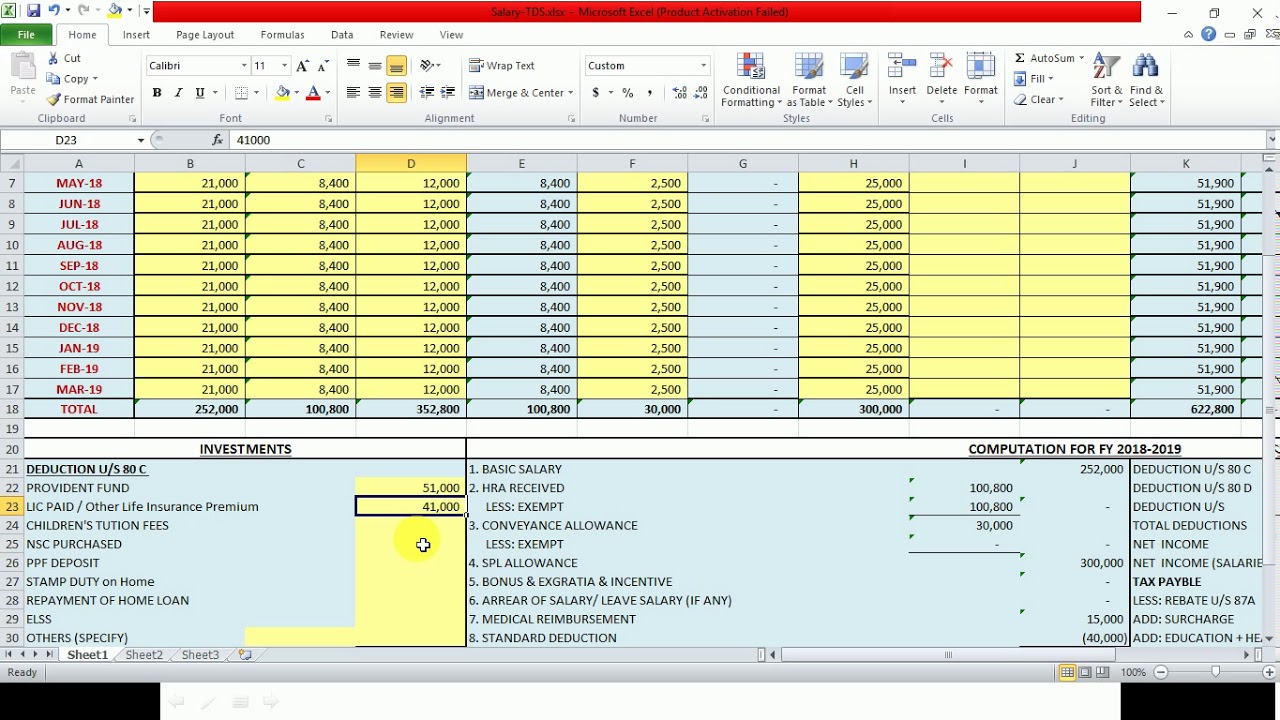

How to calculate TDS on Salary Section 192[Explained] YouTube

Gross Debt Service Ratio - GDS: The gross debt service ratio (GDS) is a debt service measure that financial lenders use as a rule of thumb to give a preliminary assessment about whether a.

HOW TO CALCULATE TDS ON SALARY TDS RATES ON IMPORTANT

They're looking to purchase a home and have estimated their monthly housing costs to be as follows: $2,500 - Mortgage payments. $250 - Property taxes. $110 - Utilities. $200 - 50% of.

How to calculate TDS on Salary? YouTube

Total Debt Service Ratio - TDS: A total debt service ratio (TDS) is a debt service measure that financial lenders use as a rule of thumb when determining the proportion of gross income that is.

How to Calculate TDS on Salary? TDS Calculation on Salary 202122

To calculate your TDS ratio, divide your total debt payments by your gross income and multiply that result by 100: [Total Debt Payments / Gross Income] x 100 = TDS. Just like the GDS ratio, lenders usually have a maximum threshold for the TDS ratio, typically ranging from 40% to 44%. A higher TDS ratio indicates that a larger proportion of your.

Excel based Tax TDS Calculator Namkalvi

Total debt service ratio, or TDS, is one of two key calculations lenders use to determine how much money they are willing to lend for a mortgage. (The other is gross debt service ratio, or GDS.

TDS on Salary How to Calculate TDS Fibe

Unsecured Debt Calculation in TDS Ratio - For Unsecured Debts in TDS Ratio Calculation, we will include a Monthly Payment of 3% of the Outstanding Balance. For Example: If $10,000 are outstanding on an Unsecured Line of Credit, then the payment included in the TDS Ratio Calculation will be: $10,000 x 3% = $300 . Factors affecting TDS Ratio